how to become cpa lawyer

Ad Penn State Graduate Taxation Programs. Ad Pass Your Test With Online Practice Tests Courses Videos Developed by Experts.

San Jose Tax Attorney And Cpa David Klasing

Advance Your Career While You Work.

. WHAT EDUCATION DO YOU NEED TO BECOME A TAX ATTORNEY. Apply for your Pennsylvania CPA License. After you have completed your professional education passed the exams and retain the necessary work experience you have fulfilled a.

Becoming dually-qualified gives you far greater insight and perspective than your average lawyer or. 150 Credit Hours from an accredited university. Surgent Students Are Passing Each Exam Section In 46 Hours On Average.

Inspire The Profession Innovate The Practice And Impact The World. Study To Become a Paralegal Online After 20 Months Of Instruction - Get Info. Before you enter law school you need to be a holder of a baccalaureate degree and must meet certain number of units of certain subjects in your college transcript di ko tanda pero merong.

The Power Of The Dual View. Rogers energy UWorlds revolutionary Qbank will help you get to the finish line. The section below describes the educational requirements.

Ad Become A Lawyer With A Degree From Liberty University School Of Law Apply Now. To become a Certified Public Accountant CPA you must pass the CPA Board Exam and of course graduate as an Accounting Major in college. Acquire 150 hours of college credit that meet your state.

Once this step is completed they must. A professional license as well as a knowledge of accounting and the law. Ad Get real CPA Exam questions and comprehensive explanations.

Step 4 Apply for licensure from your states Board of Accountancy. Lawyers can obtain the CPA designation by completing 150 semester hours of education at the undergraduate or graduate level. The crux of this answer is being a CPA and a lawyer gives you two things.

One has to earn a pre-law degree mostly political scienceliberal arts and should pass the Board exams for lawyers. If youre stuck call your state board of accountancy and ask them how to become a CPA in their state given your unique situation. Ad Award-winning software personalizes exam prep getting you ready faster.

Complete one of the following. That was a lot of work but youve finally made it. Work For Various Organizations.

Ad Award-winning software personalizes exam prep getting you ready faster. Try it for free. Obtain one to two years of work experience under the supervision of a CPA or for as long as your state requires.

Try it for free. Surgent Students Are Passing Each Exam Section In 46 Hours On Average. Bachelor degree or above.

Why CPAs Should Consider A Law Degree. Based on the passing average of both board exams becoming a lawyer is. Ad Proven flashcard system raises CPA exam scores in hours.

In order to get your CPA license you must obtain one year of supervised experience in a position within. Licenses are renewed on a three-year cycle set by the Illinois Department of Financial and Professional Regulation IDFPR the licensing body for CPAs in Illinois. The key requirements for becoming a CPA are listed below.

You can audit and certify financial. Bachelors degree usually in. The final step is to make application to the State of Utah Department of Professional Licensing for your CPA License.

Learn what it takes to become a lawyer in the Philippines with this step-by-step guide written by a Filipino attorney. Some states also stipulate an ethics examination check details with your state licensing board. After passing the uniform CPA exam take the following steps.

How do you become a CPA lawyer. Earn Your Taxation Graduate Degree or Certificate through Penn State World Campus Online. Accounting Course Requirements.

In California to earn the prestige associated with the CPA license individuals are required to demonstrate their knowledge and competence by passing the Uniform CPA Exam meeting. Ad Manage Cases While Providing Support To Attorneys. 7 yearsBecoming a lawyer usually takes 7 years of full-time study after high school4 years of undergraduate study followed by 3 years of law school.

Prepare for your next exam with our comprehensive study guides practice tests videos. Now just sit back. 1 Obtain a graduate degree in.

Tax attorneys need a bachelors degree and a JD. How To Become a Lawyer in the Philippines. Most states and jurisdictions require.

Is Studying To Become A Cpa Similar To Studying For The Bar To Be A Lawyer

Differences Between Cpas And Tax Attorneys Milikowsky Tax Law

The Power Of The Dual View Cpas Should Consider A Law Degree

What Does An Accounting Lawyer Do Best Accounting Degrees

The Power Of The Dual View Cpas Should Consider A Law Degree

7 Skills Cpas Need And How To Get Them Robert Half

Can I Combine An Accounting Degree With A Law Degree Top Accounting Degrees

What Is A Cpa And How Do I Become One Coursera

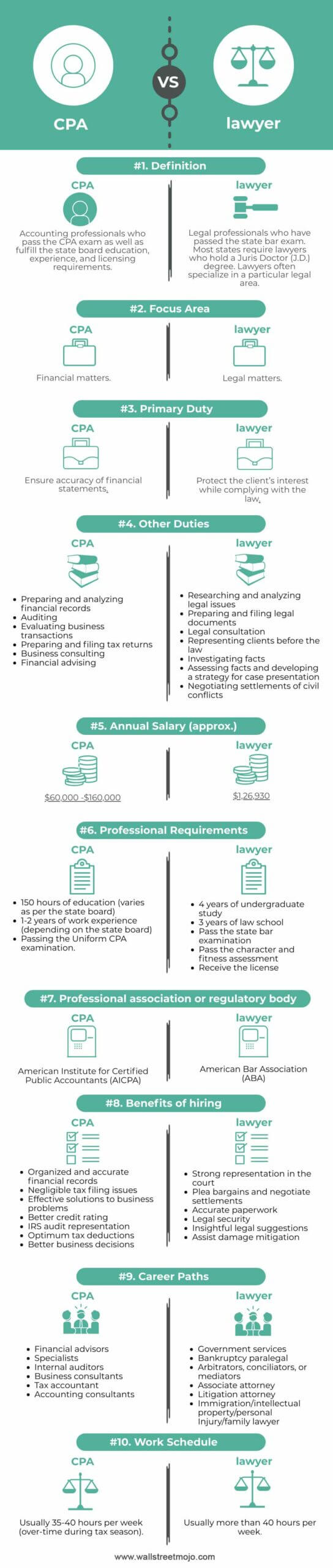

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Tax Attorney Top 10 Differences With Infographics

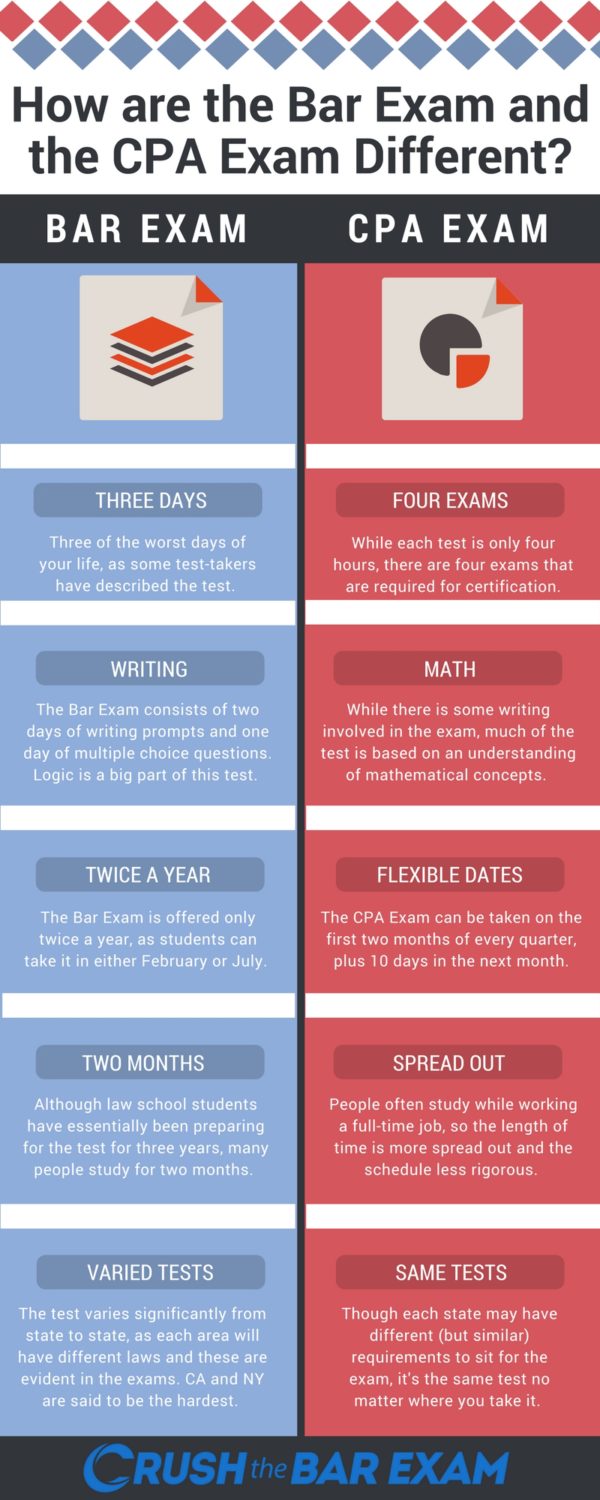

Cpa Exam Vs Bar Exam Which One Is Harder Crush The Bar Exam 2022

/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)

Accounting Vs Law What S The Difference

Rules On Cpa Certificate Of Fs Preparation Philippines

5 Disadvantages Of Being An Accountant Cpa Traceview Finance

Cpa Lawyer Shares Advice From Uncommon Career Path Mays Impacts Mays Business School

Cpa Vs Lawyer Top 10 Best Differences With Infographics